Best Demat Account in India [Open Demat Account Online]

Have you ever wondered what the best Demat account in India is?

Wonder no more! In this blog post, I will discuss India’s 7 best Demat accounts. These are some of the country’s most popular and well-rated Demat accounts.

So whether you are just starting with stock trading or a seasoned investor, one of these accounts should suit your needs perfectly. Read on to learn more!

What is a Demat Account?

A Demat account is a financial institution-maintained account where your securities are stored electronically. The process of turning physical shares into electronic form is known as the dematerialization.

A Demat account is required to trade in shares on a stock exchange. Opening a Demat account is similar to opening a bank account. You must fill out an application form and submit KYC (know your customer) documents. Once your account is opened, you will be given a user ID and password that you can use to access your account online.

You can hold various types of securities in your Demat account, such as shares, bonds, mutual fund units, etc. These securities can be bought and sold online. Additionally, you can use your Demat account to use your assets as collateral for a loan.

Benefits of having a Demat account are:

1. Convenience: You can hold all your securities in a single account and trade them online. This is much more convenient than holding physical shares.

2. Safety: Electronic securities are much safer than physical forms. There is no risk of them being stolen or damaged.

3. Flexibility: You have the option of using your assets as security for a loan. In times of financial difficulty, this can be useful.

4. Lower costs: Transaction costs are lower for an electronic form of securities.

5. Quick and easy transfer: Transferring securities from one Demat account to another is quick and easy.

If you plan to invest in shares or other securities, you should open a Demat account. It is a convenient and safe way to hold your securities.

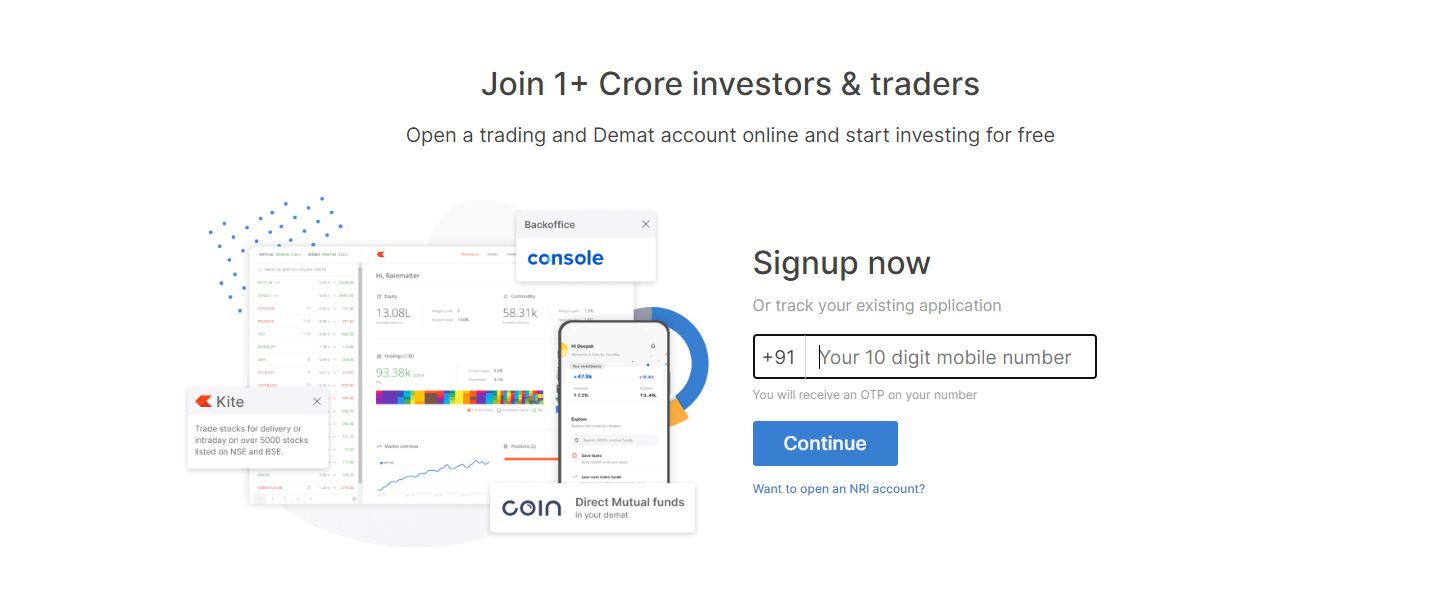

Zerodha

A Zerodha provides one of the top Demat accounts that enable investors to hold and trade securities in an electronic format. A dematerialized or Demat account allows investors to buy, sell, or hold shares and other securities electronically.

The main benefit of a Zerodha Demat account is that it eliminates the need for physical paper certificates. This makes buying, selling, or holding shares and other securities much easier and more convenient.

Another benefit of having this account is that it provides investors with a higher level of security. Since all transactions are done in an electronic format, there is no risk of losing or misplacing physical paper certificates. Additionally, electronic records are less susceptible to fraud and tampering.

Once you have a Zerodha Demat account, you can buy and sell shares online. You can also hold shares in your account and transfer them to another broker if you wish. Zerodha Demat accounts are very convenient and easy to use.

If you are an investor interested in buying, selling, or holding shares and other securities, then a Zerodha Demat account may be right for you. Contact a Zerodha representative today to learn more about how a Zerodha 3-in-1 account can benefit you.

Key Features:

1. Equity Delivery Trading: This allows you to buy and sell shares for delivery (i.e. not for immediate resale). When you place an order for delivery, the shares are transferred from the seller’s Demat account to your Demat account.

2. Equity Intraday Trading: This allows you to buy and sell shares for immediate resale (i.e. not for delivery). When you place an order for intraday trading, the shares are transferred from the seller’s Demat account to your trading account.

3. Equity Options Derivatives Trading (F&O): This allows you to trade in futures and options contracts on the stock exchange. Futures and options are derivative instruments that derive their value from the underlying asset (in this case, shares).

4. Currency Derivatives Trading (F&O): This allows you to trade in currency futures and options contracts on the stock exchange. Currency derivatives are derivative instruments that derive their value from the underlying asset (in this case, foreign currencies).

5. Commodity Derivatives Trading (F&O): This Zerodha account type allows you to trade in commodity futures and options contracts on the stock exchange. Commodity derivatives are derivative instruments that derive value from the underlying asset (in this case, commodities).case, commodities).

User Experience:

I started trading with Zerodha and have been absolutely satisfied with their services. They offer a very user-friendly platform that is easy to use and navigate. Moreover, the customer support team is always available to resolve any queries I may have. Overall, I am highly satisfied with Zerodha Demat account in India and would recommend it to others.

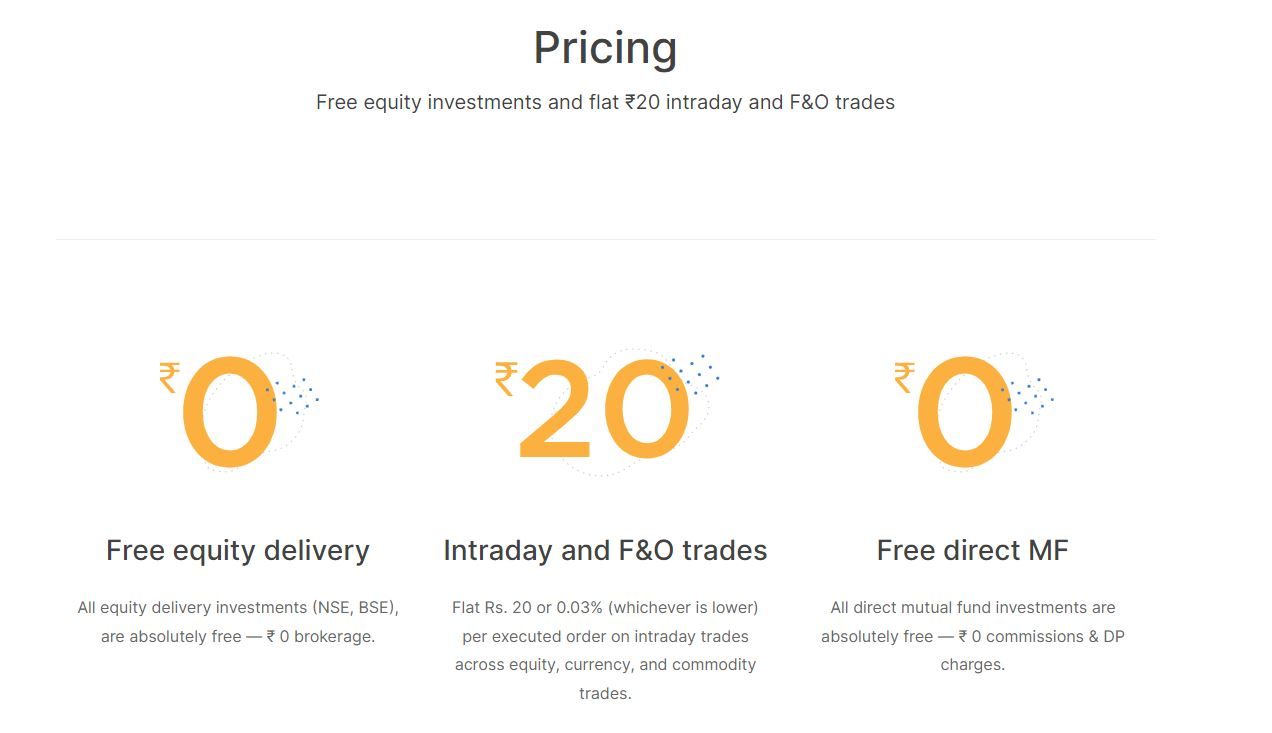

Pricing:

Zerodha offers three pricing plans:

- Free equity delivery – Rs.0 per month

- Intraday and F&O trades – Flat Rs.20 per month

- Free direct MF – Rs.0 per month

Pros:

1. It is a leading discount broker in India that offers investors and traders an opportunity to trade in equity futures, currency, and commodity markets at highly competitive rates.

2. It provides one of the most user-friendly trading platforms, Zerodha Kite, which makes trading simple and easy to understand, even for first-time investors.

3. It offers various investment options, including equities, derivatives, currency futures, and commodities.

4. With Zerodha, investors can benefit from real-time market information and analysis tools that help make informed investment decisions.

5. It also provides an online customer support team to assist investors with their queries and doubts.

Cons:

1. Although Zerodha is a discount broker, it charges higher brokerage rates than its competitors.

2. Zerodha doesn’t provide any research reports or advisory services to its clients, which can be a drawback for serious investors.

Product Reviews:

Upstox

Upstox is one of the leading online trading platforms in India. Launched in 2011, it offers a reliable and user-friendly platform for traders to invest their money in stocks, mutual funds, commodities, currencies and more. It also allows you to seamlessly open a Demat account with them to trade your shares. With simple and easy-to-use features, Upstox makes trading a breeze for all its users.

One of the biggest advantages of opening an account with Upstox is its extremely low trading fees. You can place trades as low as Rs 20 and even trade-in options for just Rs 10 per contract.

Another benefit is that no minimum balance is required to start an account. This means you can start investing with just a few hundred rupees and grow your investments as you gain more experience in the market.

The platform allows users to trade across various assets – from stocks and mutual funds to commodities and currencies. You can also access real-time quotes and market-wide analyses to help you make well-informed investment decisions.

These features are backed by a highly responsive customer support team available 24/7 to answer your queries and help you with any issues you might be facing.

If you are looking for an easy, reliable way to invest in the stock markets, Sign up with Upstox today to take advantage of your investing options.

Key Features:

1. Save costs: It offers competitive pricing on trading and Demat account fees, helping you to save money on your investment transactions.

2. Industry heavyweight: As one of the largest and most reputable brokerages in the industry, Upstox has established itself as a trusted partner for investors.

3. Seamless account opening procedure: With a quick and easy online application process, Upstox makes it simple to open an account and get started with your investments.

4. Superior technology: With advanced trading platforms, automated order execution systems, and various other innovative features, Upstox offers industry-leading tools and techniques for managing your trades.

5. Quality customer service: From responsive support staff to extensive educational resources, Upstox is committed to providing top-quality customer service that meets the needs of every investor. Whether a novice or an experienced trader, you can rest assured that Upstox has the resources and expertise to help you succeed.

User Experience:

I have used Upstox for several years now, and I can confidently say that it is one of India’s best online trading platforms. The platform is incredibly user-friendly and easy to use, making it perfect even for beginners just starting out in the world of investing. In addition, their customer support is top-notch, and they are always available to answer my questions or help with any issues I might have.

Overall, I highly recommend Upstox to anyone looking for a reliable and user-friendly trading platform in India. Whether you are just starting investing or are an experienced trader looking for the best tools and features, Upstox is the perfect choice for you. So why wait? Sign up today and start trading like a pro!

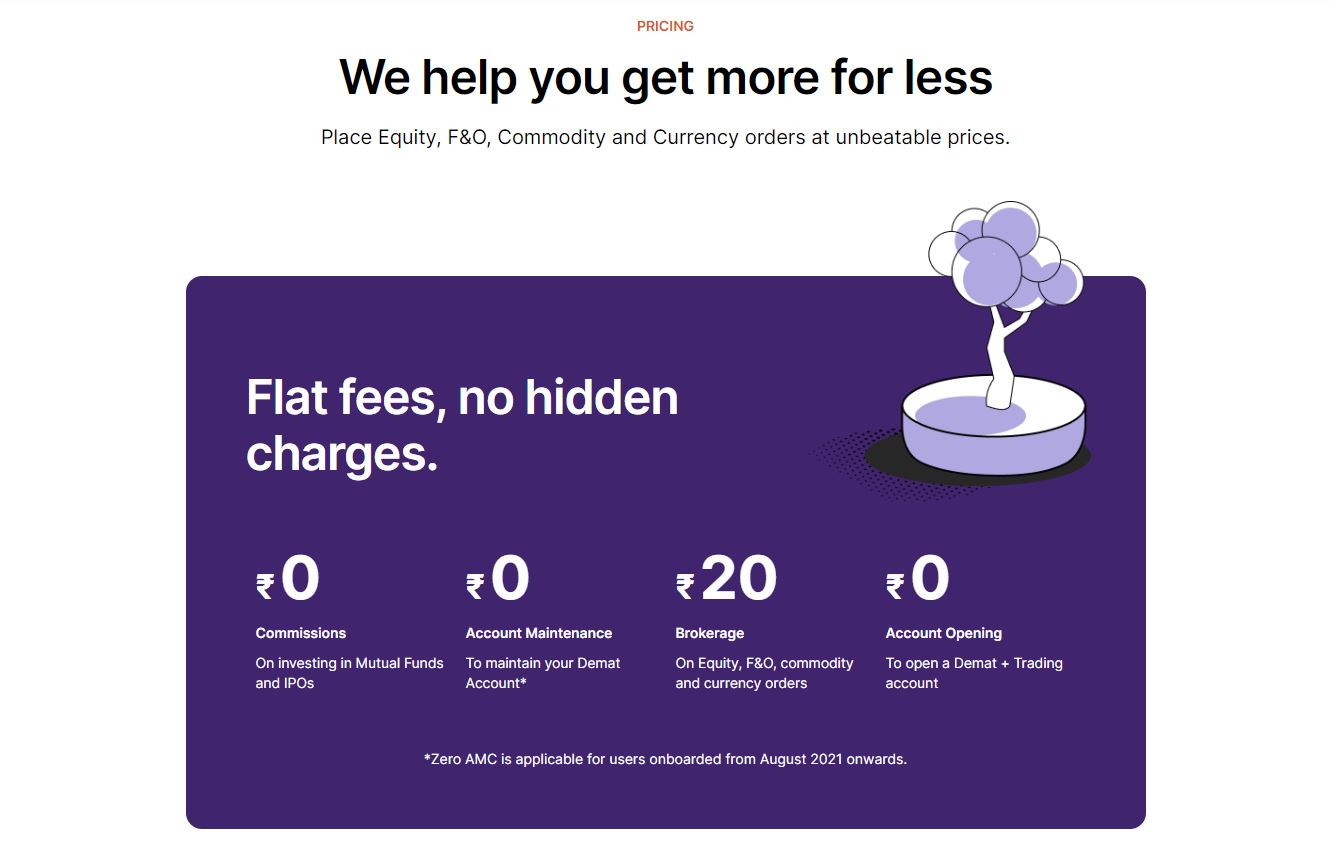

Pricing:

Upstox offers four pricing plans:

- Commissions – Rs.0

- Account Maintenance Charges – Rs.0

- Brokerage Charges- Rs.20

- Account Opening – Rs.0

Pros:

1. Upstox Demat and trading account is a cost-effective platform for online traders, with competitive brokerage rates and low minimum deposit requirements.

2. The platform has a user-friendly interface that makes it easy to navigate and conduct trades.

3. It also provides a wide range of investment products, including options, futures, and currency futures.

4. However, it does not offer very high leverage or margin expansion features, which may limit the range of trades that traders can conduct.

5. In addition, a lack of advanced charting tools and research reports may make it difficult for more experienced traders to fully utilize the platform’s trading capabilities.

Cons:

1. Upstox account opening charges are relatively high, which may be a deterrent for some investors.

2. The customer support offered by Upstox is not always reliable, which can be frustrating if you have questions or concerns about your investments.

Product Reviews:

5Paisa

5paisa Demat is an online brokerage account that lets you invest in stocks and other securities. These accounts are typically very affordable, and most brokers offer them for free or low fees. In order to open a 5paisa Demat account, you will need to provide certain personal and financial information about yourself and fund your account with a minimum initial deposit.

One of the main benefits of a 5paisa account is that it allows you to easily and quickly trade stocks online without having to go through the traditional process of placing an order over the phone or in person at a brokerage firm. You can also get real-time quotes and updated market information through your account, allowing you to make more informed investment decisions.

A 5paisa Demat account can be a great choice for investors seeking easy access to the stock market and trading online at low costs. With the right broker, you can enjoy a fast and convenient trading experience that allows you to make the most of your investment opportunities.

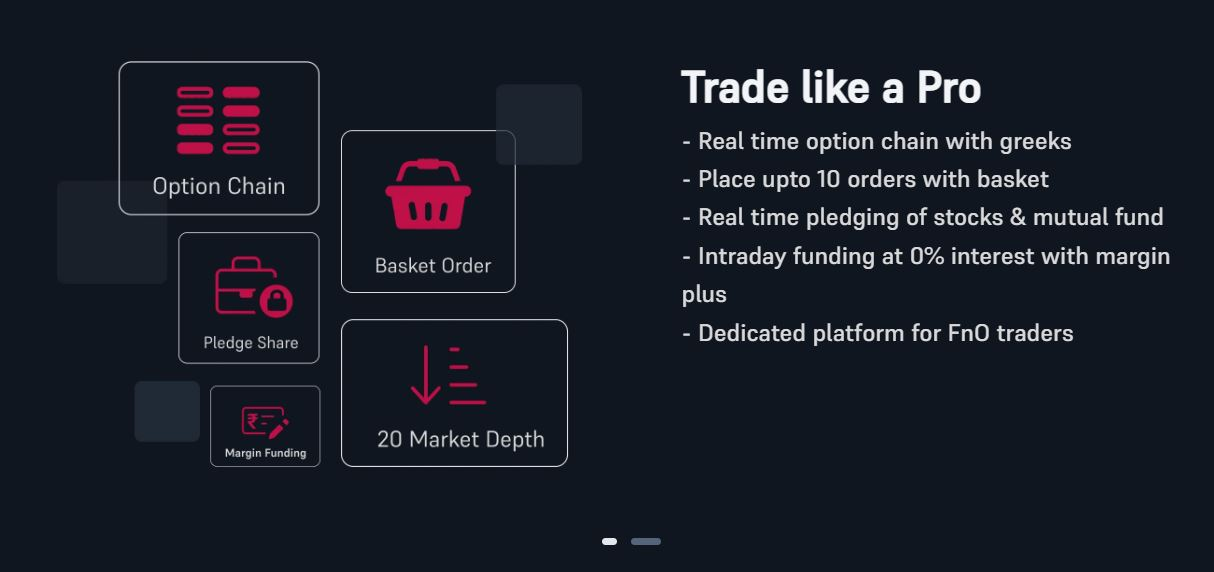

Key Features:

1. Lowest charges: It offers some of the lowest fees and commissions for trading, investing, and managing your portfolio.

2. Research Ideas: With a 5Paisa Demat account, you can access a wide range of investment research and tools to help you make informed decisions about your portfolio.

3. Margin Funding: In addition to cash trading, you can also take advantage of margin funding options through the 5Paisa Demat account,

This gives you the option to borrow money using the worth of your holdings to boost your trading power.

4. Multi-Product App: With the 5Paisa Demat app, you can seamlessly manage your tradings and investing activities on the go, including viewing real-time market data, placing trades and portfolio management services.

5. Analytics services: It provides advanced analytics tools that help you track your portfolio performance, identify trends and opportunities, and make more informed investment decisions.

6. Value-add packs: It account offers a variety of value-add packs and services, including educational resources, expert advice and recommendations, and more, to help you maximize your success in the markets. Whether you are a novice trader or a seasoned investor, you’ll find plenty of resources to help you achieve your investment goals

User Experience:

As a new investor, I was excited to open my first Demat account in India 2022. So I decided to go with 5Paisa and opened an account without hesitation. The overall process was pretty simple – simply fill out a form with the usual details and submit it along with the related documents.

Within a few days, I had my account set up and ready to use. The process was really fast and hassle-free, which I liked a lot.

The interface of their online platform is also very user-friendly and easy to navigate. All the important information about your holdings is well organized and displayed simply and clearly, making it easy to track and keep an eye on how they perform.

Overall, I am really happy with my 5Paisa Demat account and would recommend it to anyone looking for a reliable, fast, and user-friendly option.

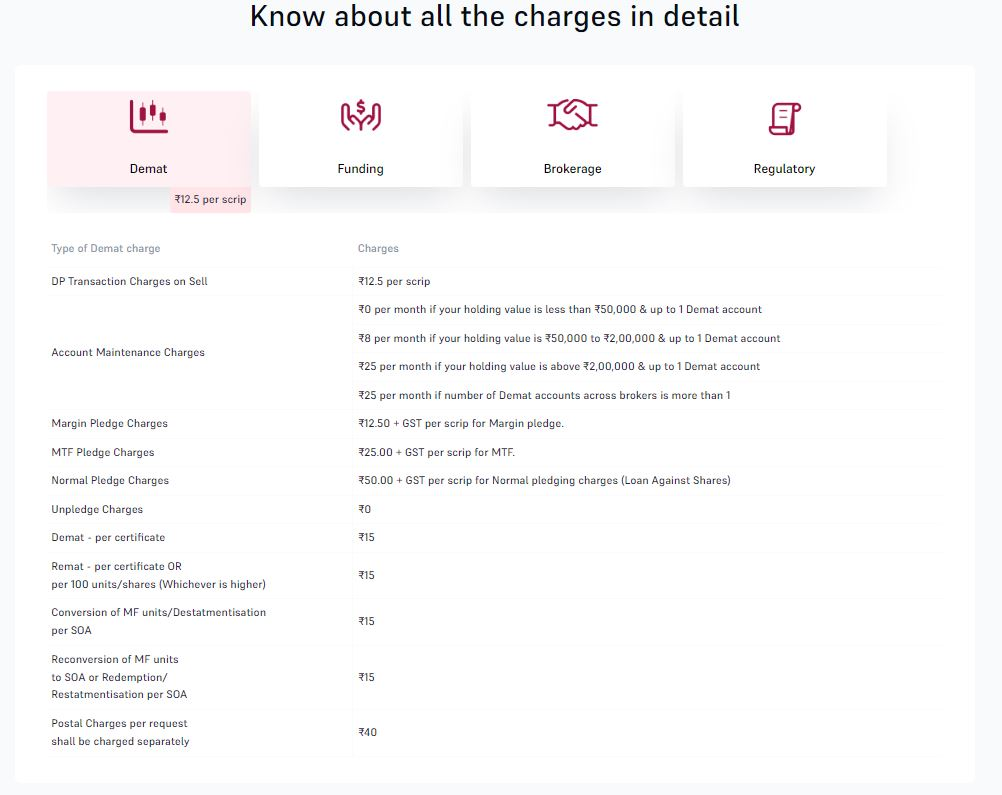

Pricing:

5Paisa offers three pricing plans:

- Demat – Rs.12.5 per scrip

- Stocks – Rs.20

- Packs – Rs.10

- Mutual Funds – Rs.0

Pros:

1. It is very convenient to use, and it is also very easy for investors to manage their transactions easily on the platform.

2. No additional charges or fees are involved when you sign up for a 5paisa Demat account. This makes it an affordable option for all investors looking to start their investment journey.

3. It gives investors access to a wide range of investment tools and services designed to help them maximize their returns from their investments. This allows them to make well-informed decisions about their investments with minimal effort.

4. 5paisa Demat account is also equipped with a robust customer support system that provides assistance and guidance to investors whenever they need it. This allows them to make the most of their investments without worrying about technical issues or queries.

5. With the 5paisa Demat account, investors can seamlessly manage all aspects of their investments, from buying and selling stocks to keeping track of their portfolio performance. This helps them stay on top of their investment goals and ensures they can reach them easily.

Cons:

1. The associated fee structure is quite high compared to the standard trading account, which makes it less attractive for small investors.

2. Since most of the Demat accounts are linked with bank accounts, there is a possibility that any payments made via cheques will be deducted from your bank account. This can lead to liquidity issues during a stock market slump

Product Reviews:

Fyers

A Fyers Demat account is an account that allows you to buy and sell stocks, mutual funds and other securities online. This makes it easy to manage your investments conveniently and efficiently.

To open a Fyers Demat account, you simply need to fill out an online application and provide basic information about yourself. Once your application form has been approved, you will receive an email with all the details you need to start trading securities online immediately.

One of the main benefits of a Fyers Demat account is that it enables you to benefit from lower transaction costs than traditional brokerage accounts. Another important advantage is that you can access your account from anywhere, at any time, thanks to the convenient online platform.

Additionally, you can take advantage of various tools and resources designed to help you make informed investment decisions and improve your overall trading performance.

Suppose you are considering opening a Fyers Demat account; research to ensure that it is the right choice for your investing needs. Consider asking other traders or investors in your local area for their recommendations. Look into the different fees and features of different providers to find one that is right for you.

With a little research and planning, you can open an account with Fyers that will help you achieve your financial goals.

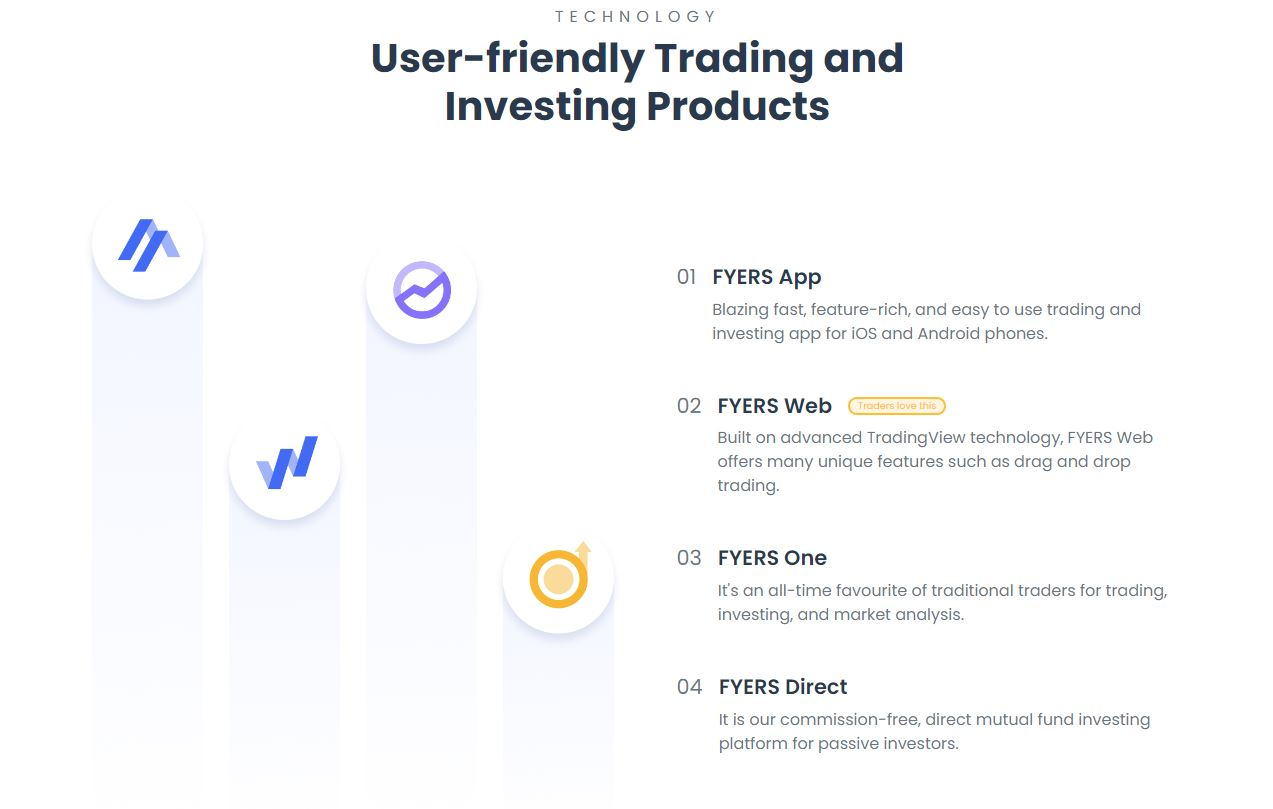

Key Features:

1. Advanced Charting: It offers extensive charting tools and indicators to help you analyze market trends and track price movements.

2. Portfolio Tracker: With Fyers’ portfolio tracker, you can easily manage your portfolio and stay on top of your trading performance.

3. FnO Analysis Tools: The platform also includes powerful financial instruments analytics tools for derivatives trading, such as options calculators, implied volatility graphs, and more.

4. Price Ladder Trading: Fyers’ unique price ladder trading interface makes it easy to execute your trades quickly and accurately.

5. Stock screener: The platform also includes a powerful stock screener that allows you to filter and sort stocks based on a wide range of options, such as market cap, P/E ratio, industry sector, and more.

6. Extremely Secure: It is one of the most secure trading platforms with state-of-the-art security features and advanced encryption technology. Whether a beginner or an experienced trader, Fyers has everything you need to succeed in today’s competitive markets.

User Experience:

When I first opened an account with Fyers, I was a bit sceptical about their services because there weren’t many reviews of the company online. However, after consulting with some friends who had used their services, I decided to try them. And boy, am I glad that I did! Their online platform is user-friendly, and they have all the tools I need to manage my investments successfully.

I also really like their customer support team, as they are always quick to respond to my queries and help me with any issues I might face. Overall, if you are looking for a reliable and trustworthy platform for your investment needs, Fyers is definitely the right choice. So why don’t you give them a try today? You won’t be disappointed!

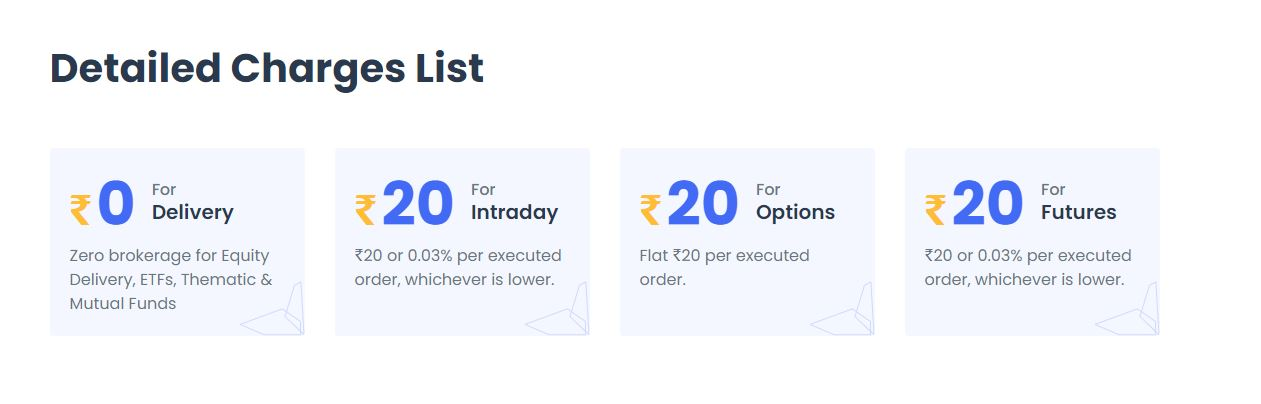

Pricing:

Fyer offers four pricing plans:

- Delivery – Rs.0

- Intraday – Rs.20

- Options – Rs.20

- Features – Rs.20

Pros:

1. One of the main advantages of using a Fyers Demat Account is that it offers easy and convenient online trading options. With this account, you can trade in different financial markets, like stocks and commodities, at your convenience without visiting a physical office.

2. Another advantage of using a Fyers Demat Account is that it offers users a wide range of tools and features that help them make informed trading decisions. This includes market research and analysis reports, which are extremely useful for investors who wish to stay updated with the latest market trends.

3. Fyers Demat Account also has several powerful risk management and security features that help traders safeguard their investments against potential market risks. This includes features like Margin Protection and Stop loss, allowing investors to trade freely without worrying about adverse market conditions.

4. Additionally, the Flyers Demat Account allows users to execute complex trading strategies at the click of a button. This is made possible through advanced tools such as Algo Trading and Direct Market Access, which allow traders to place orders quickly in various markets.

5. However, one downside of using a Fyers Demat Account is that it does not offer investors the option of leveraged trading. Traders cannot use borrowed capital to increase their market exposure and maximize their profit potential.

Cons:

1. The fees associated with the Flyers Demat account are higher than most other providers in India. This can make it difficult for some investors to use the service, as they will be less likely to generate profits from their investments if they have to pay extra fees every time they trade or purchase stocks.

2. Another potential drawback of the Fyers Demat account is that it may be more difficult to withdraw funds from your account if you need to access them in a hurry. Sometimes, processing transactions can take several business days to show up in your account, making things difficult if you are trying to get money quickly.

Product Reviews:

ICICI Direct

ICICI Direct is one of India’s leading online trading platforms, offering a wide range of investment products and services to investors across the country. The platform allows investors to trade various financial instruments, including stocks, mutual funds, bonds, currencies, and derivatives.

Additionally, it offers several value-added features that help investors make more informed investment decisions, including research reports and market news. With its user-friendly interface and intuitive design, ICICI Direct makes it easy for investors to quickly get started with their trading activities.

Overall, it is a great platform for investing in the Indian financial markets. If you are interested in learning more about ICICICI Direct and its many features, visit the website today. You can also get started by signing up for an account and exploring all these outstanding platform offers.

With its wide range of investment options and exceptional customer support, the ICICI Securities Demat account is sure to be a great choice for all your trading needs. So why wait? Start investing with ICICI Direct today!

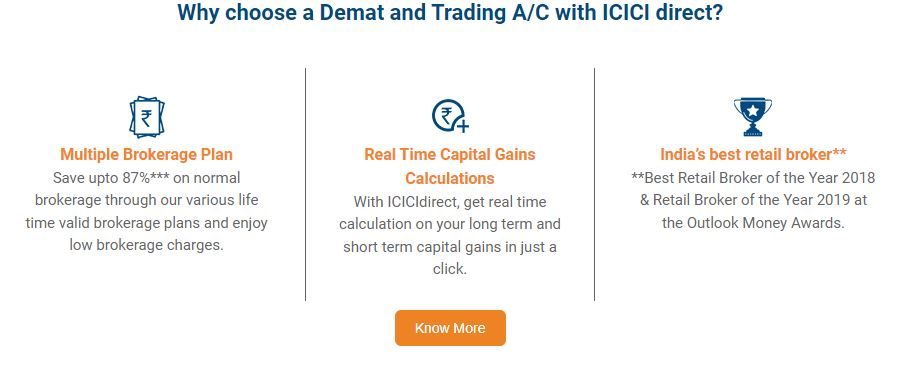

Key Features:

1. Lower risk: One of the key benefits of using an ICICI Direct Demat account is that it allows you to manage your investments more effectively, with lower risks and greater returns.

2. No issues with odd lots: Unlike other investment platforms, ICICI Direct does not limit the number of shares or units purchased at one time, making it ideal for investors with smaller portfolios.

3. Eliminates Loss: By focusing on reducing risks and maximizing returns, the ICICI Direct Demat account helps to eliminate potential losses and ensure that your investments are always growing.

4. No TDS on Demat securities: With the ICICI Direct Demat account, you do not have to worry about paying additional taxes on your investments, as there is no TDS charged on securities held in a Demat form.

5. Freezing Demat accounts: Another key benefit of the ICICI Direct Demat account is that it allows you to freeze your account if you need to take a break from investing. This ensures that your investments are protected, even if you cannot actively manage them.

User Experience:

I have been using an ICICI Direct Demat account in India for several years, and I have to say that it is one of the most user-friendly accounts available. Not only it offers a safe place to hold my shares and other securities, but it also makes redemption and selling quick and easy. And with the increasing use of digitalization in the financial sector, there is a reduced chance of errors with this account.

Overall, I have been very pleased with my experience using this account and would highly recommend it to anyone looking for an easy and convenient way to manage their securities and other investments.

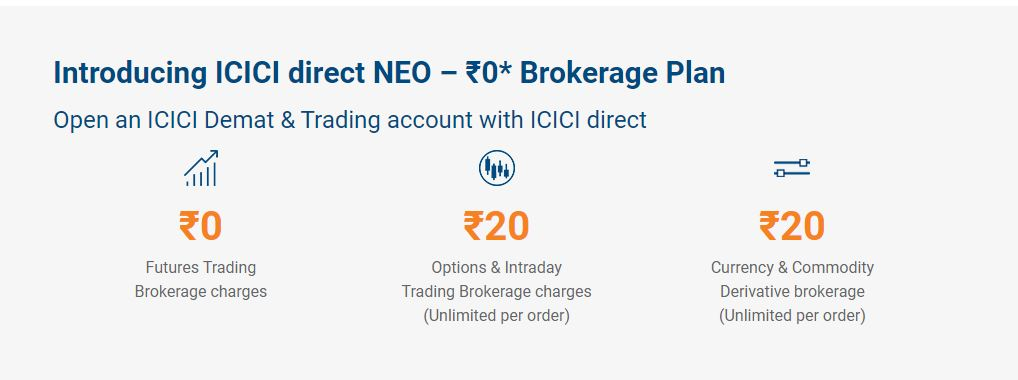

Pricing:

Pros:

1. One of the biggest advantages of opening an ICICI Direct Demat account is that it provides investors with a wide range of investment options. This includes stocks, mutual funds, government securities and more.

2. Another benefit is that it offers users a variety of online tools and resources to help them make better investment decisions. This includes tools for tracking portfolio performance, market news and more.

3. Another pro of using an ICICI Direct Demat account is that it helps investors save time and money by allowing them to trade online or on the go with their mobile devices. This allows users to manage their investments however they want, even when away from their computers.

4. A further advantage of using this account is that it offers users various online and offline support services to help them with any questions or issues. This can include customer service over the phone or live chat and resources like online tutorials and FAQs.

5. One final advantage of using this account is that it provides investors with a wide range of investment opportunities, including stocks, mutual funds, bonds, government securities and more. This allows users to access a wider range of investment options and take advantage of the most promising investment opportunities.

Cons:

1. ICICI Direct Demat account charges may apply when you request physical copies of your stock certificate. While this is fairly standard with most brokerages, the fees can be quite high and may not be worth it for smaller investors who don’t trade frequently or in volume.

Angel One

Angel One is one of the best Demat accounts in India, offering a wide range of services to investors and traders. The account provides users access to multiple stock exchanges across the country, allowing them to trade on the go and make informed investment decisions.

Some of the key features of Angel One include fast account activation and quick fund transfer options. The platform also offers a wide range of research tools and real-time data, allowing users to make informed investment decisions. In addition, the account also provides users with round-the-clock customer support and dedicated assistance from industry experts.

If you are an investor or trader looking for the best Demat accounts in India, then Angel One is the ideal choice for you. To learn more about this platform and to sign up for an account today, visit the Angel One website.

Key Features:

1. Lower risk: It offers a wide range of asset classes that help to diversify your portfolio and reduce your overall risk exposure.

2. Easy holding: With an Angel One Demat account, you can easily hold both physical and electronic securities in a single place, making it easy to manage your investments.

3. Odd lots: Angel One Demat account supports transactions in odd lot sizes, so you can easily buy or sell even minor amounts of securities without worrying about minimum purchase requirements.

4. Reduced costs: Using an Angel One Demat account can reduce the costs associated with trading and holding your investments, as there are no annual maintenance fees or other hidden costs.

5. Reduced time: With fast online account setup, low clearing and settlement fees, and instant fund transfers, an Angel One Demat account can help you save time when managing your investments.

User Experience:

I have been using my Angel One Demat account in India for several years now, and I am quite impressed with the overall user experience of this account. The interface is very easy to use and navigate, making it simple for me to track my investments and keep up-to-date information about my portfolio at all times. In addition, the customer service team at Angel One is always quick to respond to any questions or concerns that I have. Overall, I recommend this Demat account to anyone looking for a reliable and easy-to-use option in India!

Pricing:

Pros:

1. One of the biggest pros of the Demat account is that it provides 24/7 access to your trading and investment accounts. This means you can check your balance, trade or make changes to your portfolio anytime.

2. Another benefit of this Demat account is that it allows you to buy and sell shares and other financial products in various ways, including through the web, mobile phone or tablet. This makes it very convenient and user-friendly for investors on the go.

3. A third advantage of the Angel One Demat account is that it offers fast settlement times when you trade with other brokers. In addition, it offers very low transaction costs, which can help save you money in the long run.

Cons:

1. One potential downside of the Angel One Demat account is that it does not offer a wide range of financial products for trading and investment purposes. You may need to open multiple accounts if you want to invest in other types of securities or financial instruments, such as options or futures.

Product Reviews:

Paytm Money

Paytm money is an online Demat account that allows you to invest and trade in various stocks, mutual funds, IPOs, ETFs, and other securities. With Paytm Money, you can easily manage your investments online without paying additional fees or commissions. This makes it a great choice for investors looking for an affordable way to invest their money.

One of the benefits of using Paytm Money is that it gives you access to a wide range of investment options. Whether looking for traditional investments like stocks and mutual funds or newer types of securities such as IPOs and ETFs, Paytm money has something for everyone. You can also use the platform to invest in cryptocurrencies and other alternative assets, making it a great choice for investors looking to diversify their portfolios.

In addition to its robust investment options, Paytm money offers excellent customer support and helpful educational resources. With an easy-to-use interface and a wealth of information on various types of investments, you can be confident that your investments are in good hands.

So if you are looking for the top Demat account in India to invest and trade in the stock market, Paytm money is an excellent choice. Sign up today to get started!

Key Features:

1. Competitive pricing: Paytm Money offers low trading fees and commission rates, making it an affordable option for investors at all experience levels.

2. Simple and smart search: With a user-friendly interface and powerful search tools, Paytm money makes it easy to find the investments that best meet your needs.

3. Hassle-free account opening: Opening a Paytm Money account is fast and straightforward, with no paperwork or complicated forms to fill out.

4. Investing and trading: Whether you’re just starting or are an experienced investor, Paytm money offers a wide range of investment options to help you grow your portfolio.

5. Stock performance and fundamentals: With access to real-time data on stock performance and key financial metrics, Paytm money makes it easy to stay informed about the investments you choose.

User Experience:

I have been using Paytm Money’s online Demat account for several months now, and I can say that it is one of the best platforms available in India. This platform’s user interface is intuitive and easy to use, making it ideal for beginners who are just starting to invest in the stock market.

In addition to the user-friendly interface, one of the biggest advantages of using Paytm Money is that it offers a wide range of investment options. Whether you are looking for short-term or long-term investments in stocks, commodities, mutual funds, etc., this platform has something for everyone.

Another great feature of this online Demat account is that it lets you track your investments and performance in real-time. This means that you can stay on top of all your investments and make changes as needed, helping you to get the best returns possible.

Overall, I highly recommend Paytm Money to anyone looking for a reliable investing platform in India. Their user-friendly interface, extensive investment options, and real-time tracking tools make it a great choice for beginner investors. So if you are looking to get started with investing in the stock market, be sure to check out Paytm Money online Demat account today!

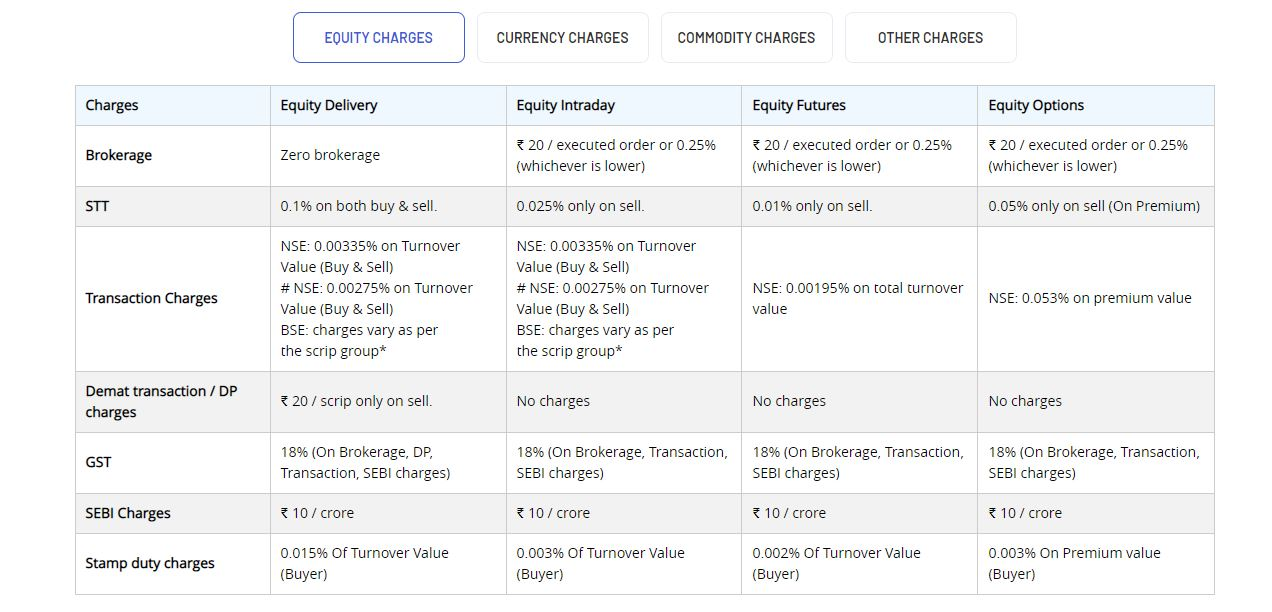

Pricing:

- Check their website for pricing.

Pros:

1. One of the biggest benefits of having a Paytm Money Online Demat Account is that it offers a wide range of investment options to help you grow your wealth over time.

2. Another advantage of this type of account is that the management fees are relatively low compared to other online brokers, making it more affordable for investors.

3. A third benefit of a Paytm Money Online Demat Account is that it offers convenient and secure online trading tools, making it easy to monitor your investments and make trades quickly.

4. Additionally, having a Paytm Money Online Demat Account can give you access to a wide range of investment research materials and tools to help you make well-informed decisions about your portfolio.

Cons:

However, one potential drawback of a Paytm Money Online Demat Account is that it may not offer all of the investment options you are looking for, which could limit your ability to grow your wealth over time.

Product Reviews:

Conclusion:

In the end, finding a Demat account that fits your needs is important. Do your research and compare all the options available to you to make an informed decision. Consider what features are most important to you and look for an account that offers those services. With so many great choices, there is no reason not to find the best Demat account for your needs. Have you opened a Demat account yet? Which is the best Demat account for trading? What was the deciding factor in choosing your particular account?

FAQ

How to Open a Demat Account?

When it comes to Demat account opening in India, there are several important factors that you need to keep in mind. First and foremost, you must choose a reputable brokerage firm or bank that offers reliable Demat services. You should also ensure that the firm or bank is registered with the Securities and Exchange Board of India (SEBI) and holds a valid registration certificate.

Once you have chosen a firm or bank, you will need to gather the documents required for account opening. These typically include proof of identity (such as your passport or driver’s license), proof of address (like a utility bill or bank statement), photo ID for any joint owners or co-signers (such as a passport), and any other documents that the firm may require.

Once you have your documentation, you can contact the firm or bank to initiate the account opening process. This typically involves filling out an application form and submitting it with the required documents. Once your account is set up and activated, you can use your Demat account to buy and sell securities.

Opening a Demat account in India is a fairly straightforward process that requires time and attention to detail. By taking the necessary steps and following these tips, you can rest assured that your account will be set up quickly and easily.

How to Open a Demat Account in Zerodha?

Opening a Demat account with Zerodha is a simple process. To start, simply visit the Zerodha website and click the “Sign Up” button to begin the registration process.

Next, you will be asked to provide basic information about yourself, including your name, date of birth, address, and contact details. You will also need to choose a username and password for your account and select your preferred currency and trading platform.

Once you complete the registration process, you can begin placing trades on Zerodha’s powerful trading platform. Be sure to take advantage of this platform’s many features, including real-time market data, powerful charting tools, and advanced order types.

What Documents are Required for a Demat Account in India?

Documents are an essential part of any financial transaction. When it comes to opening a Demat account in India, there are several documents that you will need to provide to complete the process.

Some of the most common documents required for a Demat account include proof of identity, proof of address, recent passport-sized photographs, and copies of your bank statements. Additionally, depending on the type of Demat account you are opening, you may be asked to provide additional documentation, such as proof of income or tax returns.

Suppose you are planning to open a Demat account in India. In that case, it is important to ensure that you have all the required documents ready and easily accessible before you begin the application process. This will help to ensure that your account can be opened quickly and easily and that you can take advantage of the many benefits of having a Demat account in India.

Hope you liked this Article on Best Indian Demat account 🙂