What is Asset Leasing? How to make Money from Investing in Assets?

What is Asset Leasing?

Asset leasing is purchasing assets from a company and then transferring ownership rights to one or more people who will manage the asset. Asset leasing can be utilised as a source of money for a company to buy equipment, property, machinery, real estate, and other assets that will be used to run the company.

Leasing is a simple contractual arrangement in which the lessee (user) makes regular payments to the lessor (owner) in exchange for the use of an asset for a specified period of time. Buildings, cars, and equipment are among the most often leased assets.

Consider this scenario: you and 2 friends (owners/lessors) invest in aircraft equipment that is then leased to an airline (users/lessee) for its operations and the company pays you all a monthly rental. That’s all there is to it.

The user of the asset has 3 ultimate choices at the end of the lease: pay a residual and acquire the equipment, sell the equipment, or re-finance the residual and extend the lease.

Leasing out an asset is quite a profitable venture and can generate a great amount of passive income.

Given that you stick within your budgetary restrictions.

Before we dive into how and why should we invest, let’s understand what some common investment terms actually mean.

ROI (Return on Investment): Return on investment (ROI) is a metric that investors use to determine how well their investment in a company is performing — and to assist them in making the critical decision of whether to sell a stock and move on or continue with it. Potential investors can utilise ROI to help them choose between several companies in which to put their money.

IRR (Internal Rate Of Return): The projected percentage of return from the project is measured by the internal rate of return (IRR). The interest rate is calculated using the project’s starting cost and forecasts of future cash flows. In general, corporations should accept projects that have an IRR greater than the cost of capital and reject those that do not.

How to Invest in Assets in India?

1. The first step would be to look for an asset leasing company that has a great track record of returns in the past and is offering competitive rates to its investors.

2. Once you have a company in hand, look into the types of assets that they have to offer.

3. Making an investment choice here is crucial, assets can vary in terms of pricing and returns, the asset must fit into your budget and shouldn’t exceed your risk tolerance levels even if the asset returns MAY seem attractive.

4. Once you have made a choice on the asset and the tenure you would like to go for, you can very well contact your agent pr broker, to set you up with the respective asset and you can then begin the lease contract.

Advantages & Pros of Asset Investing in India

Some of the prime advantages of this model are

- Returns that are predictable

Monthly payments are agreed upon in advance for the duration of the lease, with no day-to-day fluctuations like stock markets. Fixed lease payments are provided for steady and high distribution rates throughout the operating periods of most programmes, resulting in consistent cash flow.

- Collateral Strength

Leasing usually comes with a purchase money security interest (PMSI), which means the lessor owns the equipment legally. In comparison, a loan in which the lender may hold a lien on an asset is a far worse position than a PMSI.

- Benefits from Taxes

Depreciation and costs can be claimed to lower the effective tax rate for lessors (you)

- Low Correlation

Carefully underwritten lease receivables can endure the most severe market downturns in both equity and debt markets.

- Less Volatile than the Stock Market

The leasing system is more stable than the stock market since it is governed entirely by the lease agreement and is not impacted by market waves.

- Return diversification

Because leasing is a pretty steady choice, the rate of return is likewise more or less stable; additionally, they can provide an Internal Rate of Return (IRR) of up to 20%+, which can help diversify one’s portfolio.

New entrants, such as students or people who have just started their careers, will benefit the most.

- Tax benefits

Due to the lack of asset generation, there is an advantage of depreciation, which allows one to claim it and so lower the tax burden. When compared to alternatives like an ELSS, this one is unquestionably less risky.

And guess what, Leasing agreements are quite prevalent, especially in India! Most firms, including airlines, heavy equipment companies, and manufacturing powerhouses, lease rather than own their assets. You definitely have a wide range of assets to opt from, given your budgetary constraints, of course.

Best Asset Leasing & Asset Investing Companies in India

Companies that indulge in Asset leasing in India are:

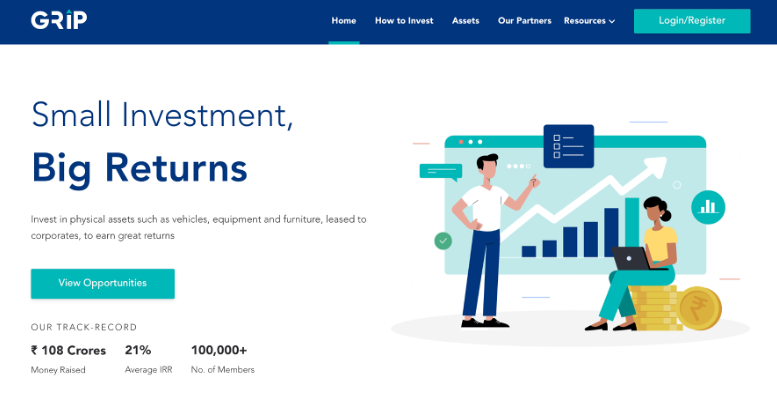

1. GRIP Investing

GRIP is an investing platform that provides handpicked lease financing investment possibilities with low minimum investment amounts and guaranteed returns. They’ve worked with some of the up and coming startups, such as Furlenco for furniture and Udaan for warehousing needs.

They’re willing to offer you the following services:

- Analysis in Depth: Unique investment options have been assessed through a thorough review process.

- Complete Discretion: All characteristics of each investment, lease terms, and potential hazards are disclosed.

- Known Co-Investors: Each asset receives at least 30% of the total investment amount from reputable investors.

- Process: Their skilled advisors will identify, execute, and manage investments for you in a simple and efficient manner.

Returns offered:

- Begin diversifying your assets with Rs 20,000.

- Returns that are appealing

- Monthly distributions with fixed, non-market related returns

- Payments are made on a monthly basis with maturities ranging from 21 to 36 months. After the lockdown period, only a few deals have liquidity.

GRIP has maintained a solid track record of raising 21 Crore rupees while offering an Internal Rate of Return (IRR) of 21% with over 100,000 members under the GRIP umbrella.

Profitably speaking, they have offered a 36% Return on investment in 3 years, while is greater than the average return on mutual funds and stock indices. 12-13% after-tax exemptions

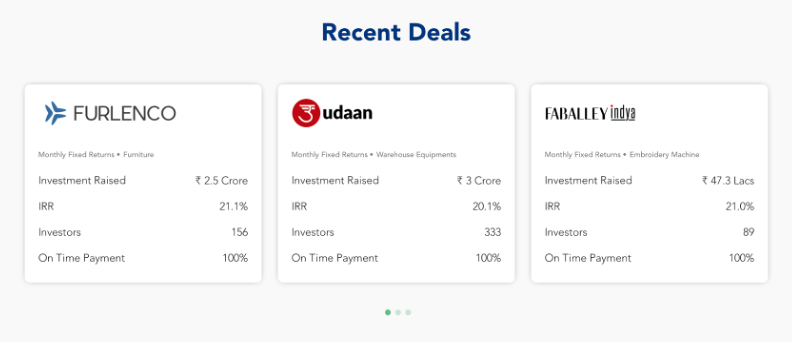

The GRIP invest team has secured some of the most well-known deals, including:

The IRR offered, ranges from 20-21% and funds raised by them are quite big in number. The pool of investors makes it much simpler to raise funds for bigger projects, hence generating an excellent return.

Grip Invest’s risk management strategy

- At the time of onboarding the partner, thorough due diligence is performed, including checks on liquidity, promoters, industry analysis, credit profiles, and marquee investors, among other things.

- Escrow mechanism, duties on revenue, upfront security deposit, PDCs, and other security measures are used to mitigate risk.

- Monthly evaluation of their partners’ company performance, as we receive monthly information from them. In addition, the Portfolio’s exposure is to fast-growing industries with well-known brands, a large client base, and minimal risk, among other things.

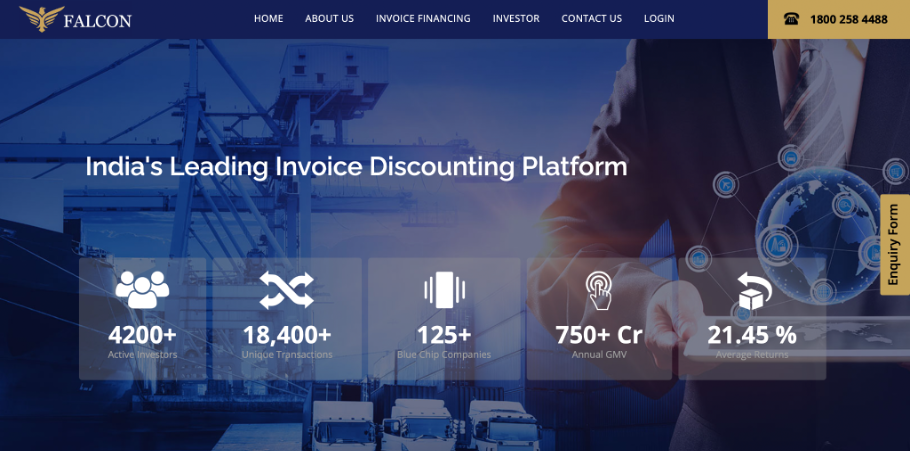

2. Falcon

Falcon is a little different from the regular asset leasing programs we have around. They are engineered towards financing working capital than fixed capital. This means they fund the day to day requirements of a business rather than massive pieces of equipment that are on the costlier end of the spectrum

Falcon offers Invoice discounting, which is a cash-on-hand alternative to typical business loans, giving you immediate access to funds held in pending invoices.

Falcon is a terrific solution for companies who like to improve cash flows, manage late payments, and keep up with seasonal demand so that they don’t have to wait for their clients to pay them; instead, you can get money immediately against your invoices.

In return, it offers its premium investors the following benefits:

- Their investors typically get a return of 14 to 23% every year, which is well above the average stock index. 12-13%after-tax exemptions

- Investing cycles of 30 to 90 days. Which lets you stay flexible and doesn’t block your funds over an extended period of time.

- Invest a minimum of $25,000 in a number of vetted and creditworthy borrowers. The quality of borrowers is supremely important. Greater the creditworthiness, the greater the assurity of returns.

- Earn monthly returns with no additional fees.

- Getting rid of financial risk with high-quality borrowers again and doesn’t depend on market cycles. Your returns are fixed and guaranteed.

As an investor, you get to finance some of the most diverse and growing fields in the country, which are; manufacturing, construction, wholesale and logistics. Making both the parties self-reliant and enable a mutually beneficial relationship.

3. PYSE

PYSE is another asset leasing company that not only focuses on leasing investment assets but those investment assets are GREEN. Assets that care about the environment and help achieve the pressing goals of sustainability. You can invest in prime projects such as a Fractional solar power plant or an electric vehicle.

PYSE has a long list of initiatives in the works that have a positive impact and meet their criteria of green investing. After their screening processes, just 1% of the projects they get as opportunities are opened for you. All projects posted on Pyse have a “pyse verified” badge, which offers you a clear picture of the rewards and dangers of the investments. The checks they perform for pyse verified are as follows:

- Examine performance

- Checking Credit score

- Operational Review

- Validation of Resources

- Validation of revenue

Pyse projects are made available through their top tier brand partners such as TATA and Bounce, allowing you to invest with confidence.

- Brands you’re familiar with and can rely on.

- Pyse’s partners have a credit rating in the top 5%.

- Asset partners are among the best in the industry, providing high-quality assets that operate well.

Some investment metrics:

In two years, even a tiny investment of INR 5000 can make you carbon neutral. Pyse allows you to invest in green assets that can yield an ROI of 12-15% after taxes. They also give liquidity after a brief time of lock-in.

Pyse has two sorts of assets: long-term assets such as solar projects and short-term/medium-term assets such as electric vehicle ownership. After a brief lock-in period, all projects come with a buyback option. Pyse, unlike GRIP Invest, solely invests in green assets.

The investment is INR 5000, which allows anyone to try it out and experience it for themselves.

- 1–25 years is a long-term investment (park your funds for an extended period of time, for interest on interest to add up to give you great returns) or…

- 3–4 months for a short-term investment which generates a quick investment turnaround.

Management of Risk

- 6-12 month cash flow guarantee from the bank

- After 6 months of lock in, you can get your money back.

- Each deal’s credit analysis is in-depth.

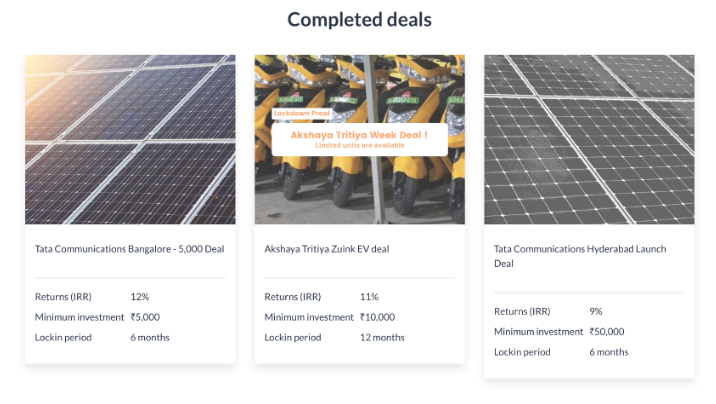

Some of the most prominent deals that have been nailed by the team at Pyse are:

They’ve managed to deliver an IRR of 9-12% in an average lock-in period of 6 months or so.

This is pretty impressive considering the investment amounts given.

Conclusion

Asset Leasing can be a good way to diversify your portfolio and earn a good return on your investments.

But as these platforms are new and not many deals have been done on them.

Always do your own Research before Investing in deals.

What I like best about Asset Leasing Investments is that the returns are predictable and known upfront, unlike Equity Investments.

You can park a very small amount from your portfolio to test waters and If satisfied can include it in your long-term Investing Methods.